1, 2002, Mississippi income tax law has required casinos to withhold a nonrefundable income tax at the rate of 3% on gambling winnings that are required to be reported to the IRS. Jul 30, 2019 But beginning with the tax year 2018 (the taxes filed in 2019), all expenses in connection with gambling, not just gambling losses, are limited to gambling winnings. What About State Taxes? In addition to federal taxes payable to the IRS, many state governments tax gambling income as well.

More Articles

Do you like to gamble? If so, then you should know that the taxman beats the odds every time you do. The Internal Revenue Service and many states consider any money you win in the casino as taxable income. This applies to all types of casual gambling – from roulette and poker tournaments to slots, bingo and even fantasy football. In some cases, the casino will withhold a percentage of your winnings for taxes before it pays you at the rate of 24 percent.

Casino Winnings Are Not Tax-Free

Casino winnings count as gambling income and gambling income is always taxed at the federal level. That includes cash from slot machines, poker tournaments, baccarat, roulette, keno, bingo, raffles, lotteries and horse racing. If you win a non-cash prize like a car or a vacation, you pay taxes on the fair market value of the item you win.

By law, you must report all your winnings on your federal income tax return – and all means all. Whether you win five bucks on the slots or five million on the poker tables, you are technically required to report it. Job income plus gambling income plus other income equals the total income on your tax return. Subtract the deductions, and you'll pay taxes on the resulting figure at your standard income tax rate.

How Much You Win Matters

While you're required to report every last dollar of winnings, the casino will only get involved when your winnings hit certain thresholds for income reporting:

- $5,000 (reduced by the wager or buy-in) from a poker tournament, sweepstakes, jai alai, lotteries and wagering pools.

- $1,500 (reduced by the wager) in keno winnings.

- $1,200 (not reduced by the wager) from slot machines or bingo

- $600 (reduced by the wager at the casino's discretion) for all other types of winnings but only if the payout is at least 300 times your wager.

Win at or above these amounts, and the casino will send you IRS Form W2-G to report the full amount won and the amount of tax withholding if any. You will need this form to prepare your tax return.

Understand that you must report all gambling winnings to the IRS, not just those listed above. It just means that you don't have to fill out Form W2-G for other winnings. Income from table games, such as craps, roulette, blackjack and baccarat, do not require a WG-2, for example, regardless of the amount won. It's not clear why the IRS has differentiated it this way, but those are the rules. However, you still have to report the income from these games.

What is the Federal Gambling Tax Rate?

Standard federal tax withholding applies to winnings of $5,000 or more from:

- Wagering pools (this does not include poker tournaments).

- Lotteries.

- Sweepstakes.

- Other gambling transactions where the winnings are at least 300 times the amount wagered.

If you win above the threshold from these types of games, the casino automatically withholds 24 percent of your winnings for the IRS before it pays you. If you cannot provide a Social Security number, the casino will make a 'backup withholding.' A backup withholding is also applied at the rate of 24 percent, only now it includes all your gambling winnings from slot machines, keno, bingo, poker tournaments and more. This money gets passed directly to the IRS and credited against your final tax bill. Before December 31, 2017, the standard withholding rate was 25 percent and the backup rate was 28 percent.

The $5,000 threshold applies to net winnings, meaning you deduct the amount of your wager or buy-in. For example, if you won $5,500 on the poker tables but had to buy in to the game for $1,000, then you would not be subject to the minimum withholding threshold.

It's important to understand that withholding is an entirely separate requirement from reporting the winning on Form WG-2. Just because your gambling winning is reported on Form WG-2 does not automatically require a withholding for federal income taxes.

Can You Deduct Gambling Losses?

If you itemize your deductions on Schedule A, then you can also deduct gambling losses but only up to the amount of the winnings shown on your tax return. So, if you won $5,000 on the blackjack table, you could only deduct $5,000 worth of losing bets, not the $6,000 you actually lost on gambling wagers during the tax year. And you cannot carry your losses from year to year.

The IRS recommends that you keep a gambling log or spreadsheet showing all your wins and losses. The log should contain the date of the gambling activity, type of activity, name and address of the casino, amount of winnings and losses, and the names of other people there with you as part of the wagering pool. Be sure to keep all tickets, receipts and statements if you're going to claim gambling losses as the IRS may call for evidence in support of your claim.

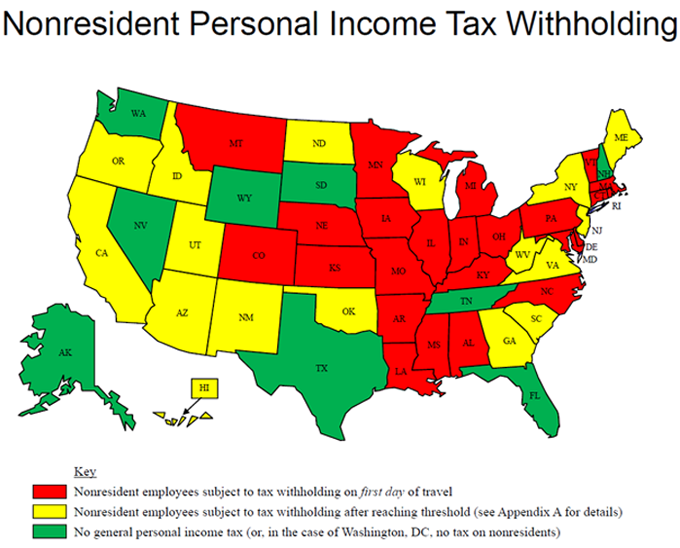

What About State Withholding Tax on Gambling Winnings?

There are good states for gamblers and bad states for gamblers. If you're going to 'lose the shirt off your back,' you might as well do it in a 'good' gambling state like Nevada, which has no state tax on gambling winnings. The 'bad' states tax your gambling winnings either as a flat percentage of the amount won or by ramping up the percentage owed depending on how much you won.

Each state has different rules. In Maryland, for example, you must report winnings between $500 and $5,000 within 60 days and pay state income taxes within that time frame; you report winnings under $500 on your annual state tax return and winnings over $5,000 are subject to withholding by the casino due to state taxes. Personal tax rates begin at 2 percent and increase to a maximum of 5.75 percent in 2018. In Iowa, there's an automatic 5 percent withholding for state income tax purposes whenever federal taxes are withheld.

State taxes are due in the state you won the income and different rules may apply to players from out of state. The casino should be clued in on the state's withholding laws. Speak to them if you're not clear why the payout is less than you expect.

California Tax On Gambling Winnings

How to Report Taxes on Casino Winnings

You should receive all of your W2-Gs by January 31 and you'll need these forms to complete your federal and state tax returns. Boxes 1, 4 and 15 are the most important as these show your taxable gambling winnings, federal income taxes withheld and state income taxes withheld, respectively.

You must report the amount specified in Box 1, as well as other gambling income not reported on a W2-G, on the 'other income' line of your IRS Form 1040. This form is being replaced with a simpler form for the 2019 tax season but the reporting requirement remains the same. If your winnings are subject to withholding, you should report the amount in the 'payment' section of your return.

Different rules apply to professional gamblers who gamble full time to earn a livelihood. As a pro gambler, your winnings will be subject to self-employment tax after offsetting gambling losses and after other allowable expenses.

Video of the Day

References (6)

About the Author

Jayne Thompson earned an LLB in Law and Business Administration from the University of Birmingham and an LLM in International Law from the University of East London. She practiced in various “big law” firms before launching a career as a commercial writer. Her work has appeared on numerous financial blogs including Wealth Soup and Synchrony. Find her at www.whiterosecopywriting.com.

Introduction to Mississippi Slot Machine Casino Gambling in 2019

Mississippi slot machine casino gambling consists of 28 riverboat casinos and 3 American Indian tribal casinos. The riverboat casinos, in fact permanently docked barges, appear as land-based casinos. International cruise ships with onboard casinos also depart from ports in Biloxi and Gulfport.

Minimum and maximum payout return limits have been legally set by the state. Further, comprehensive actual payout return statistics are available by gaming machine type and state region.

This post continues the weekly series Online Resource: A State-By-State Slot Machine Casino Gambling Series, an online resource dedicated to guiding slot machine casino gambling enthusiasts to success. Each weekly post reviews slots gambling in a single U.S. state, territory, or the federal district.

Keep Reading … or Listen Instead!

This audio contains commentary not found anywhere else!

Subscribe to the Professor Slots podcast at Apple Podcasts | Google Podcasts | iHeart Radio | Spotify | Stitcher | Pandora | Tune-In | SoundCloud | RadioPublic | Android | RSS and wherever else you find podcasts!

Relevant Legal Statutes on Gambling in Mississippi*

The minimum legal gambling age in Mississippi depends upon the gambling activity:

- Land-Based Casinos: 21

- Poker Rooms: 21

- Bingo: 18

- Lottery: n/a

- Pari-Mutuel Wagering: n/a

Gambling in Mississippi has aided to the economy of the state and breathed new life into its tourism industry. In 1990, the Mississippi state legislature was the third U.S. state to legalize riverboat gambling.

By law, Mississippi’s riverboat casinos must be located on coastal waters, the Mississippi River, and in navigable waters of counties bordering the Mississippi River.

After Hurricane Katrina in 2005, the Mississippi legislature allowed the state’s gulf coast casinos to rebuild on land within 800 feet of the shoreline.

Winning a jackpot of $1,200 or more in Mississippi results in a nonrefundable 3% tax of those winnings paid to the Mississippi Gaming Commission. This limit also applies to any cash prizes won in casino drawings and tournaments.

*The purpose of this section is to inform the public of state gambling laws and how the laws apply to various forms of gambling. This information is not intended to provide legal advice.

Slot Machine Private Ownership in Mississippi

It is legal to privately own a slot machine in Mississippi if it is at least 25 years old.

Gaming Control Board in Mississippi

The Mississippi Gaming Commission (MGC) is the state’s gaming control board for non-tribal casinos. The MGC has its own gaming regulations as well as those found within state law, specifically the Gaming Control Act.

The MGC also provides monthly gaming revenues since 2008. It separates its riverboat casinos by their physical region within the state. These three regions are:

- Central Region, including the cities of Vicksburg and Natchez

- Northern Region, including the cities of Tunica, Greenville, and Lula

- Coastal Region, including the cities of Biloxi, Gulfport, and Bay St. Louis

The Mississippi Band of Choctaw Indians also has its Choctaw Gaming Commission for Mississippi’s three tribal casinos. This gaming commission was established via the tribal-state compact and regulates tribal gaming in Mississippi.

Casinos in Mississippi

There are 28 non-tribal casinos and 3 American Indian tribal casinos in Mississippi. There are also cruise ship ports in Biloxi and Gulfport with international destinations.

The largest casino in Mississippi is Island View Casino Resort in Gulfport, having 2,700 gaming machines and 45 table games.

The second largest casino is Silver Star Casino at Pearl River in Philadelphia, having 2,500 gaming machines and 75 table games.

List of Casinos in Mississippi

Mississippi’s 28 riverboat casinos are:

- Ameristar Casino Vicksburg in Vicksburg within the Central Region located 44 miles west of Jackson on the Mississippi River

- Beau Rivage Resort & Casino in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Boomtown Casino – Biloxi in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- 1st Jackpot Casino Tunica in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- Fitz Casino Hotel in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- Gold Strike Casino Resort in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- Golden Nugget – Biloxi in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Hard Rock Hotel & Casino – Biloxi in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Harlow’s Casino Resort in Greenville within the Northern Region located 119 miles northwest of Jackson on the Mississippi River

- Harrah’s Gulf Coast in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Hollywood Casino Gulf Coast in Bay St. Louis within the Coastal Region located 91 miles west of Mobile, Alabama on the Gulf Coast

- Hollywood Casino Tunica in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- Horseshoe Tunica Hotel & Casino in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- IP Casino Resort Spa in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Island View Casino Resort in Gulfport within the Coastal Region located 75 miles west of Mobile, Alabama on the Gulf Coast

- Isle of Capri Casino Hotel Lula in Lula within the Northern Region located 59 miles southwest of Memphis, Tennessee on the Mississippi River

- Lady Luck Casino Vicksburg in Vicksburg within the Central Region located 44 miles west of Jackson on the Mississippi River

- Magnolia Bluffs Casino Hotel in Natchez within the Central Region located 103 miles southwest of Jackson on the Mississippi River

- Palace Casino Resort in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Resorts Casino Tunica in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- Riverwalk Casino Hotel in Vicksburg within the Central Region located 44 miles west of Jackson on the Mississippi River

- Sam’s Town Tunica in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

- Scarlet Pearl Casino Resort in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Silver Slipper Casino in Bay St. Louis within the Coastal Region located 91 miles west of Mobile, Alabama on the Gulf Coast

- Treasure Bay Casino and Hotel in Biloxi within the Coastal Region located 63 miles west of Mobile, Alabama on the Gulf Coast

- Trop Casino Greenville in Greenville within the Northern Region located 119 miles northwest of Jackson on the Mississippi River

- Tunica Roadhouse Casino and Hotel in Tunica within the Northern Region located 41 miles southwest of Memphis, Tennessee on the Mississippi River

WaterView Casino and Hotel in Vicksburg within the Central Region located 44 miles west of Jackson on the Mississippi River

List of Tribal Casinos in Mississippi

Mississippi’s 3 tribal casinos, each a property of Pearl River Casinos and Resorts owned and operated by the Mississippi Band of Choctaw Indians, are:

- Bok Homa Casino in Sandersville located 93 miles southeast of Jackson

- Golden Moon Casino in Philadelphia located 75 miles northeast of Jackson

- Silverstar Hotel & Casino in Philadelphia located 75 miles northeast of Jackson

Other Gambling Establishments

As an alternative to enjoying Mississippi slot machine casino gambling, consider exploring casino options in a nearby state.

Mississippi is bordered by:

- North: Tennessee Slots

- East: Alabama Slots

- South: Gulf of Mexico

- West: Arkansas Slots and Louisiana Slots

Each of the links above will take you to my state-specific blog for that bordering state to Mississippi.

Payout Returns in Mississippi

The minimum and maximum payout return limits are 80% and 100% per MGC Regulations Part 3: Operations per Rule 12.5: Minimum Standards for Gaming Devices.

These gaming regulations apply to each wager available for play on the device. Further, for skill-based games, these legal limits require a player is employing an optimal strategy for perfect play.

MGC Monthly Revenue Reports provide the most recent month’s Hold Percentage and Win Percentage. Prior reports are in the website’s Monthly Archives by month since April 2000.

The monthly Win Percentage report provides the Win% for all the casinos in total for each State Region: Central, Coastal, and Northern. Further, these state regions offer Win% for each available machine denomination as well as separate entries for progressive machines also by denomination.

For each state region and denomination, the monthly reports combine payout statistics for all electronic gaming machines, including:

- Slot machines

- Video poker machines

- Video keno machines

Finally, another monthly report is a Gaming Devices Report, which provides the number of electronic gaming machines available by denomination for each Mississippi non-tribal casino. Once again, progressive versus non-progressive machines are separate.

Relative to other U.S. gaming jurisdictions, the payout statistics provided by Mississippi are the most thorough treatment I’ve seen for payout returns.

The Mississippi Band of Choctaw Indians has not established payout return limits via its tribal-state gaming compact or its Choctaw Gaming Commission. Further, as is usual with tribal casinos in other states, no actual payout return statistics are publicly available.

Our Mississippi Slots Facebook Group

Are you interested in sharing and learning with other slots enthusiasts in Mississippi? If so, join our new Mississippi slots community on Facebook. All you’ll need is a Facebook profile to freely join this closed Facebook Group.

There, you’ll be able to privately share your slots experiences as well as chat with players about slots gambling in or near Mississippi. Come join us!

Summary of Mississippi Slot Machine Casino Gambling in 2019

Mississippi slot machine casino gambling consists of 28 riverboat casinos, three American Indian tribal casinos, and international cruise ships out of ports in Biloxi and Gulfport on the Gulf Coast.

Minimum and maximum payout return legal limits for the non-tribal casinos are 80% and 100%, respectively. Comprehensive actual payout return statistics are available within three state regions and electronic gaming machine denomination. Further, these statistics are separate for progressive versus non-progressive gaming machines.

Annual Progress in Mississippi Slot Machine Casino Gambling

In the last year, Mississippi’s second largest casino has moved into the lead position primarily by

Archive: Mississippi Slot Machine Casino Gambling in 2017

Related Articles from Professor Slots

Other State-By-State Articles from Professor Slots

- Previous: Minnesota Slot Machine Casino Gambling in 2018

- Next: Missouri Slot Machine Casino Gambling in 2019

Tax On Gambling Winning

Have fun, be safe, and make good choices!

By Jon H. Friedl, Jr. Ph.D., President

Jon Friedl, LLC